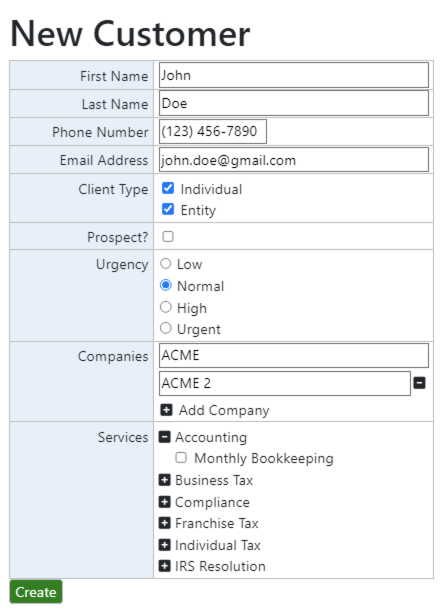

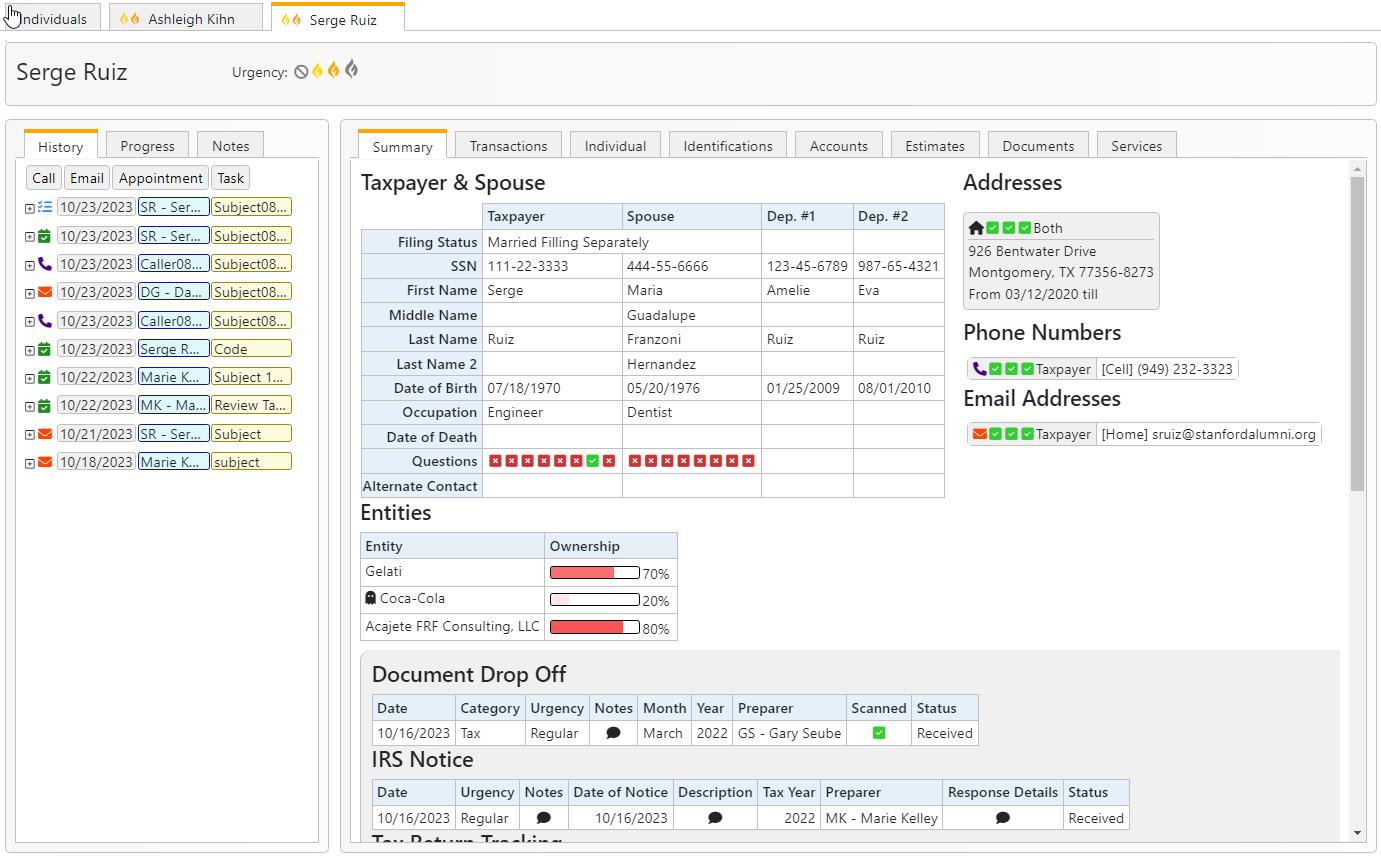

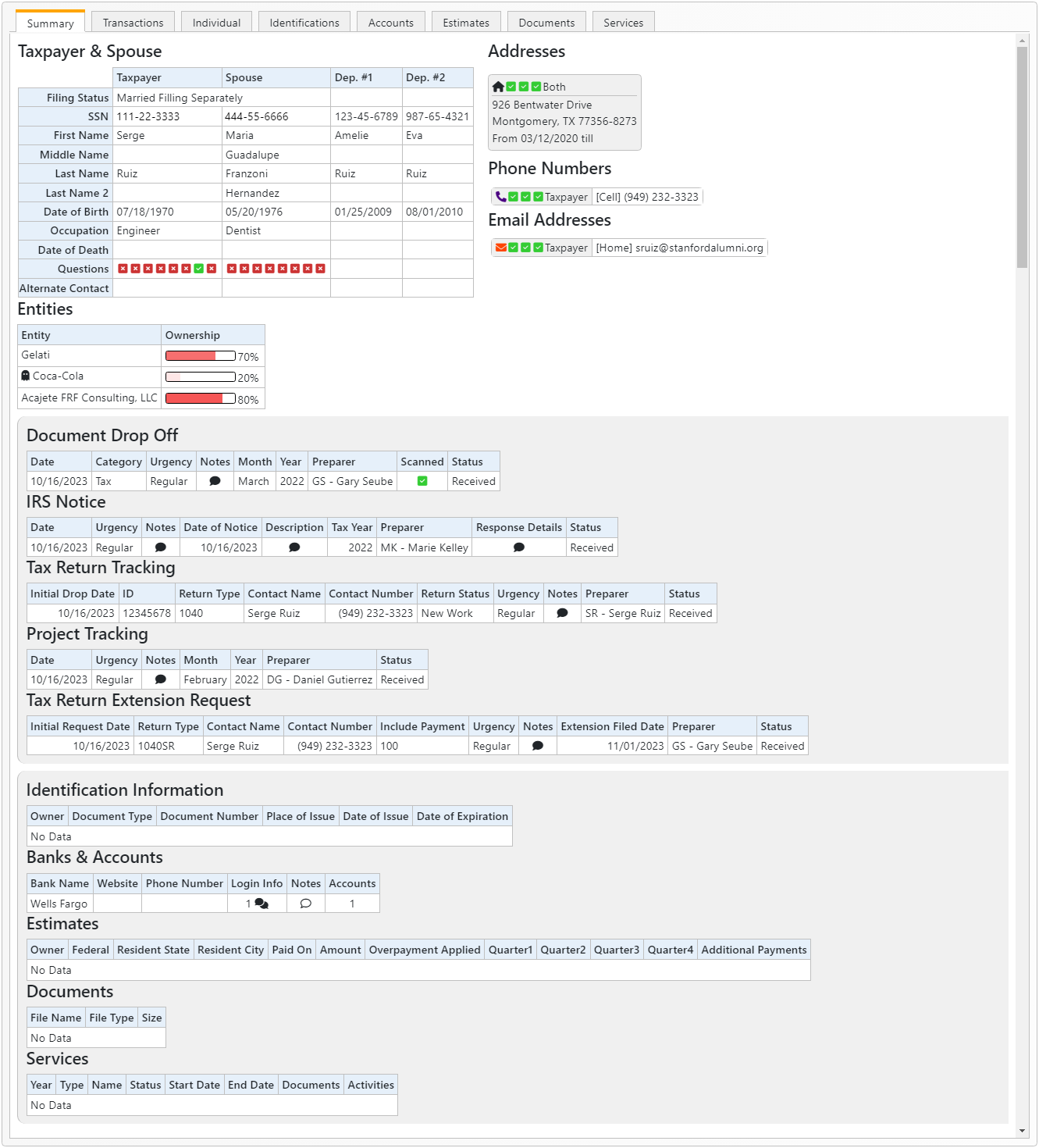

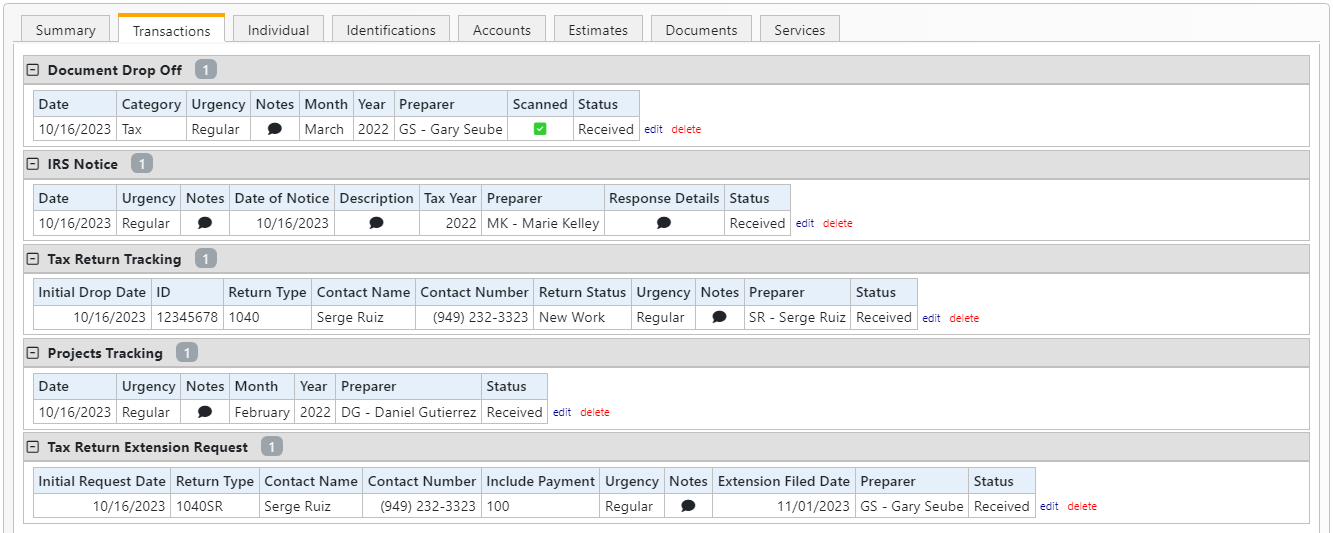

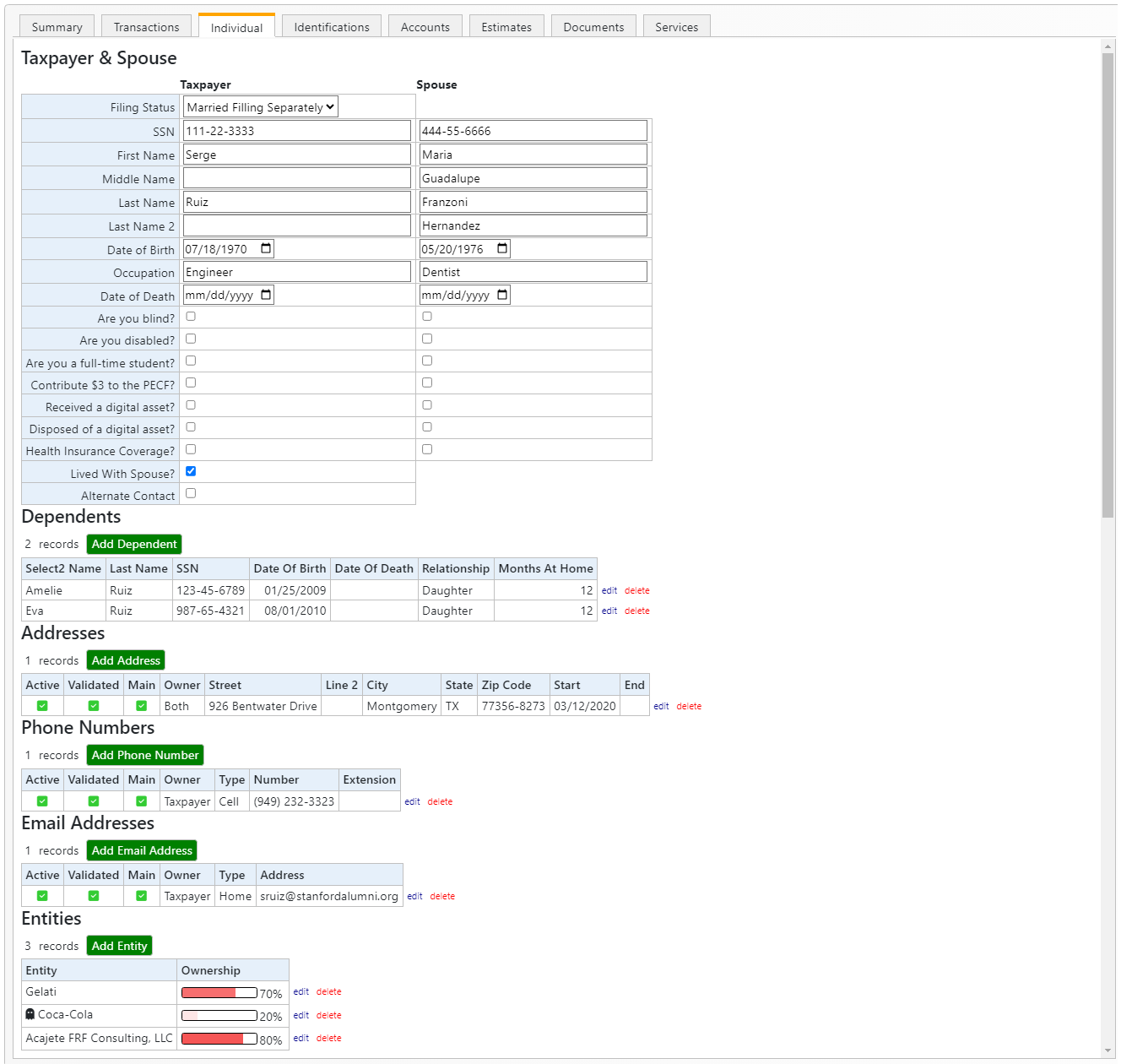

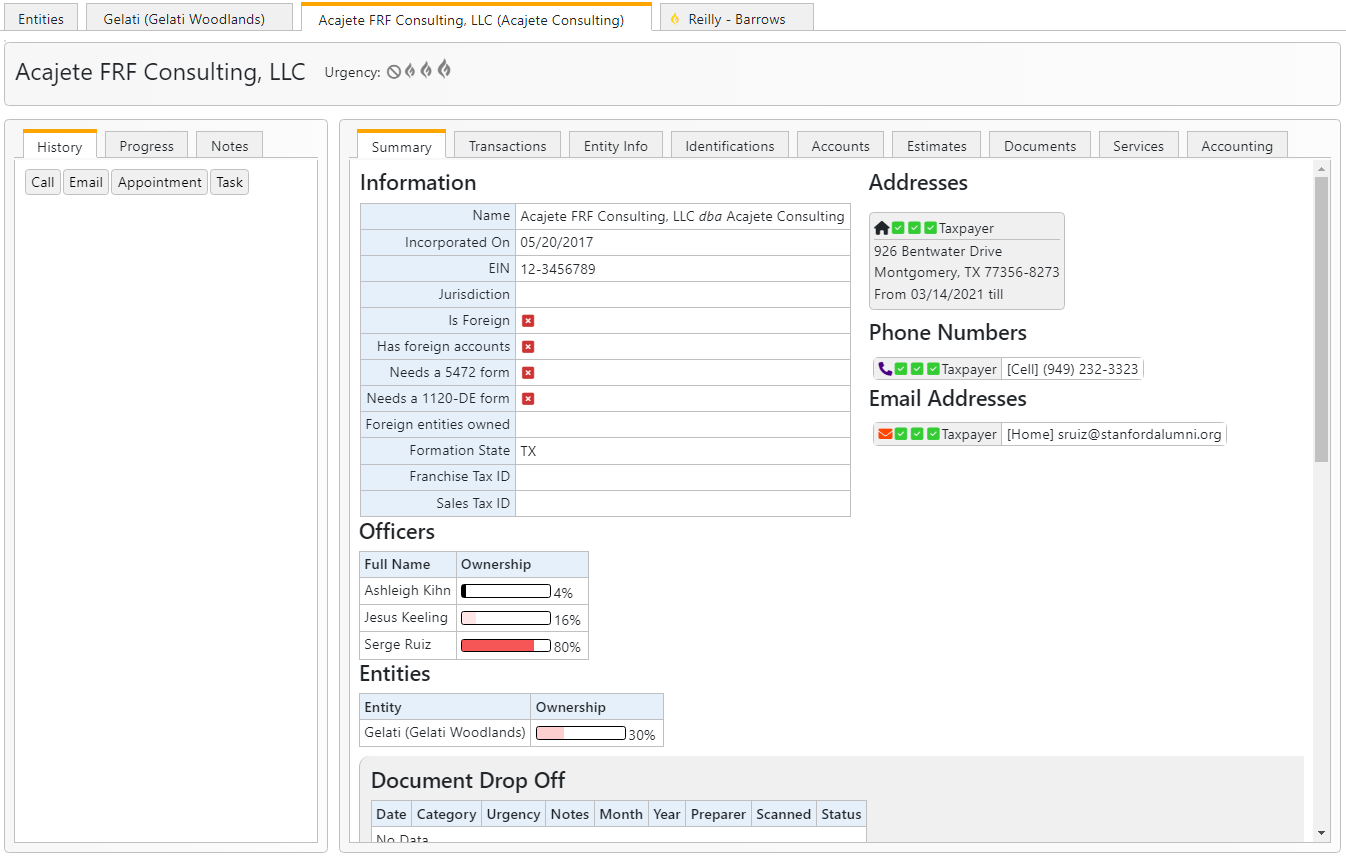

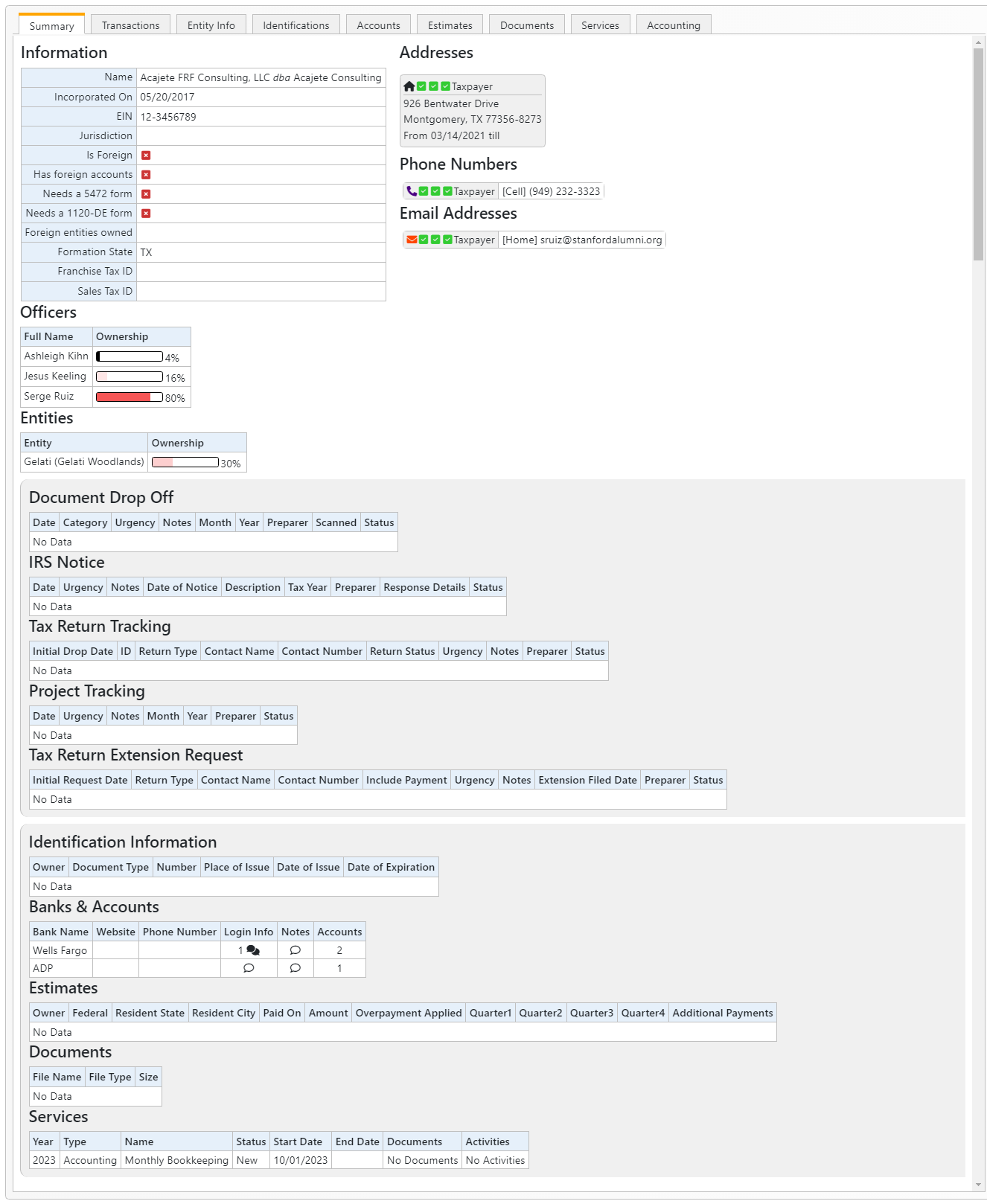

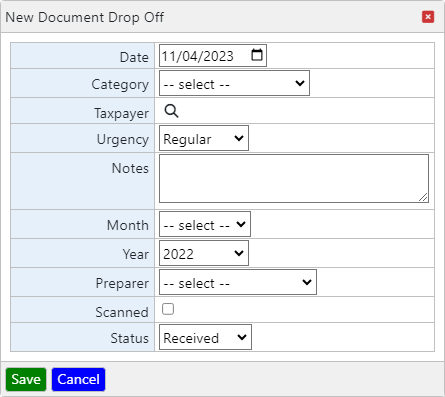

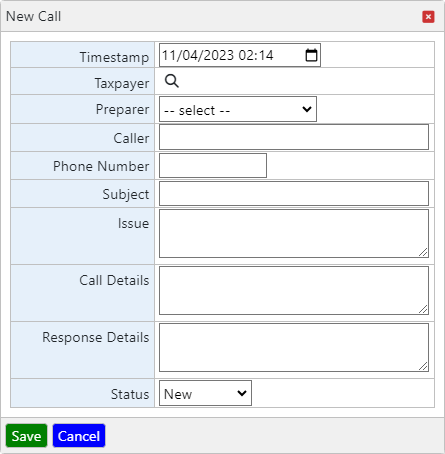

Transactions are created as work comes in. Typically, it will be triggered by a document that is received and continue with the type of document, which can then lead to the creation of a record in another Transaction table.

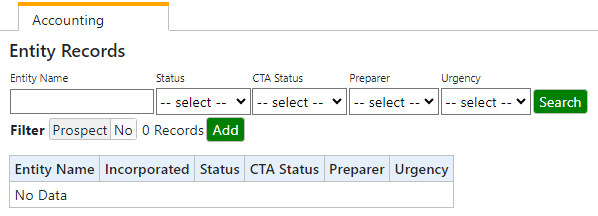

Transactions are attached to a customer but are stored in the transaction tables and bound to the customer on request. This allows for a better management of the transactions across employees.

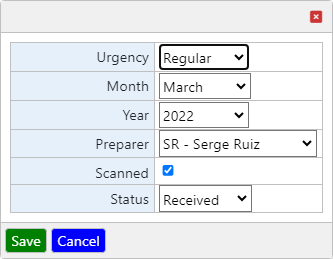

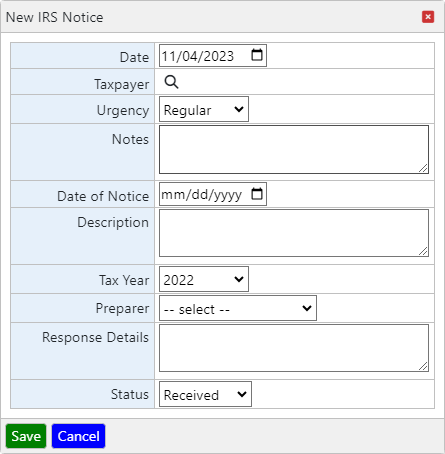

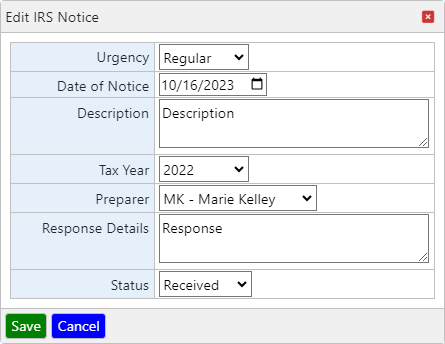

Once a transaction has been assigned to a customer, it cannot be changed. In case of an error, the transaction record(s) will have to be deleted and a new one created.

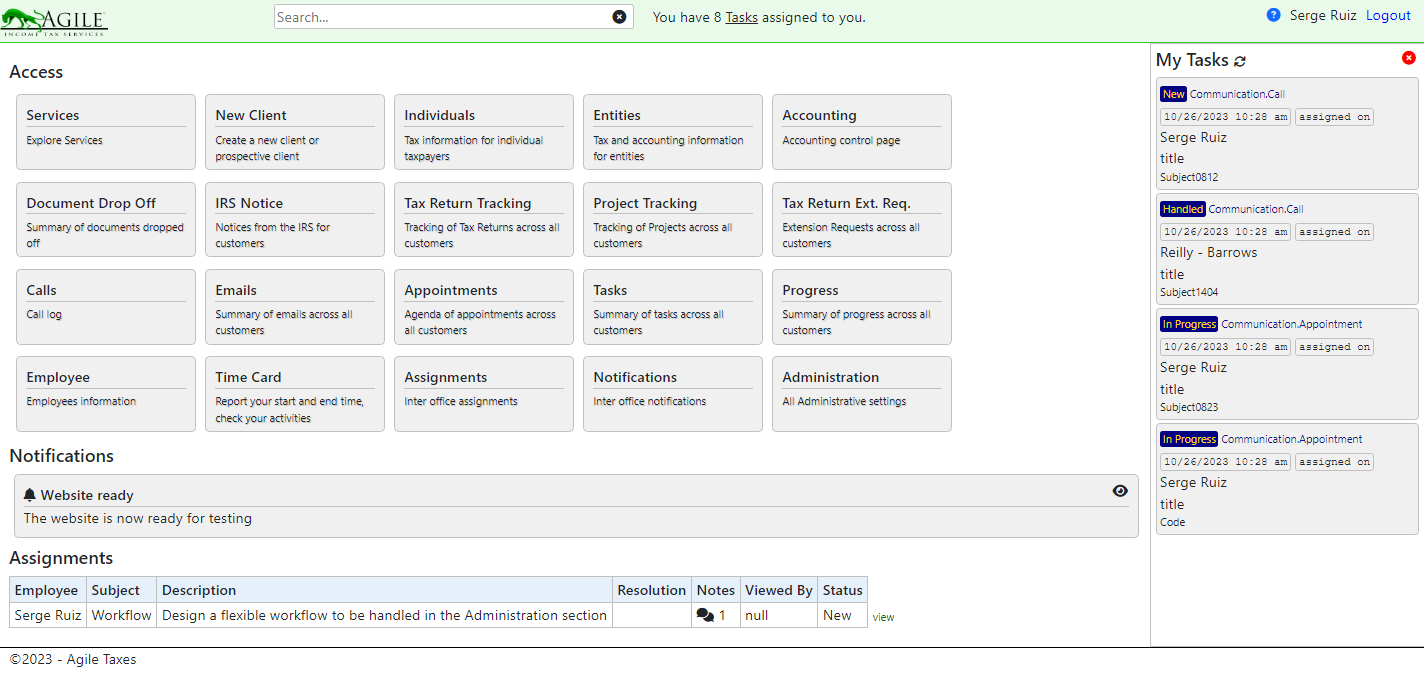

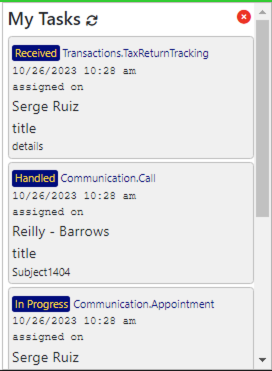

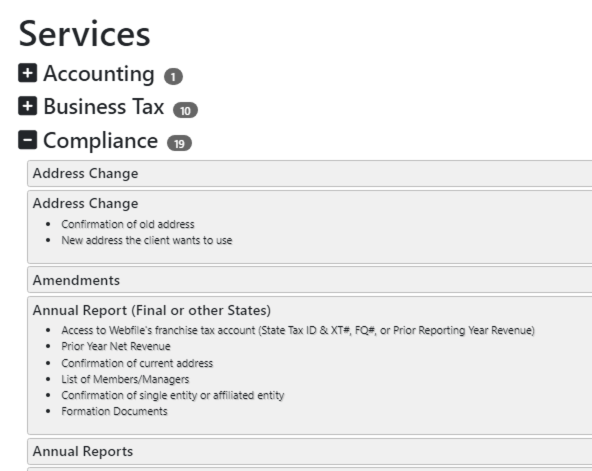

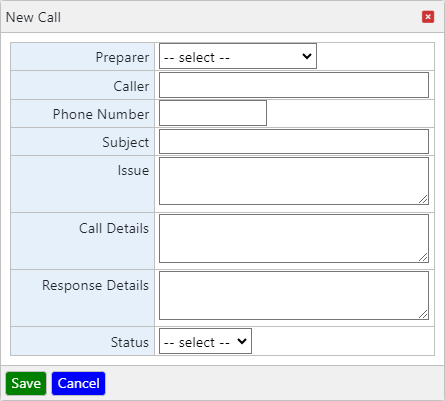

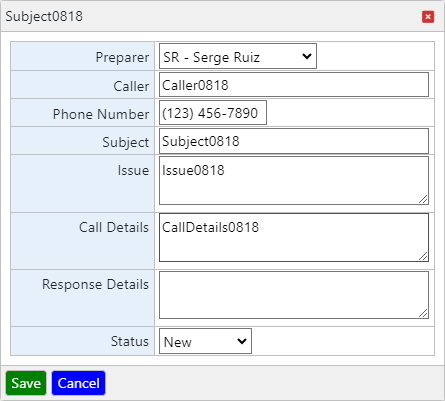

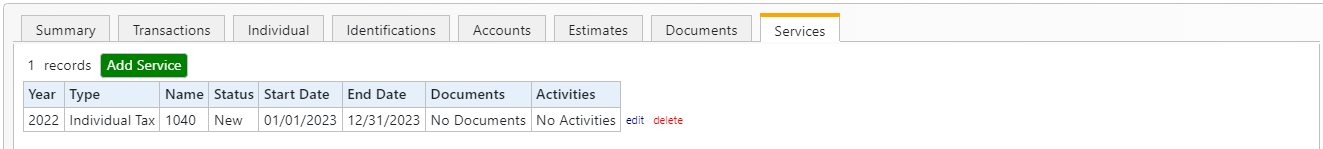

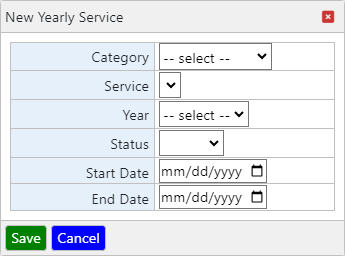

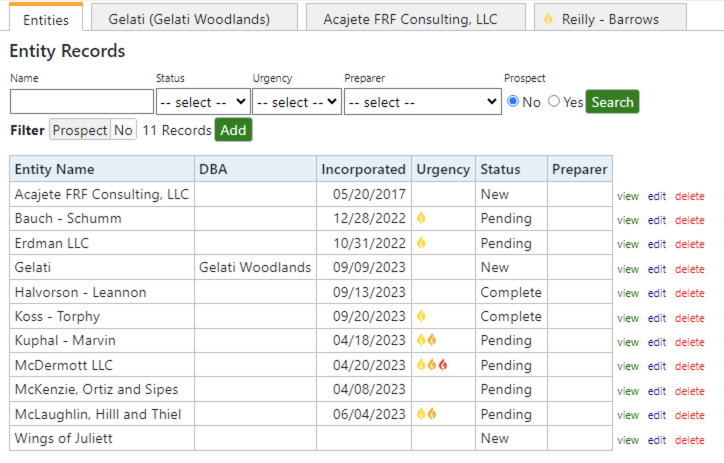

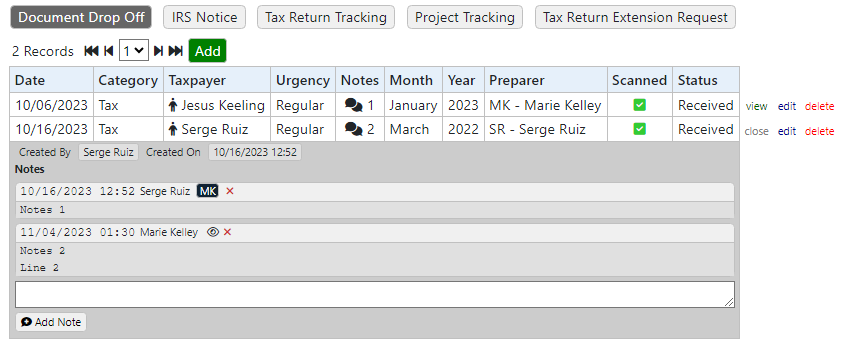

There are 5 types of transactions, they are directly accessible through the menu bar, on top. They are:

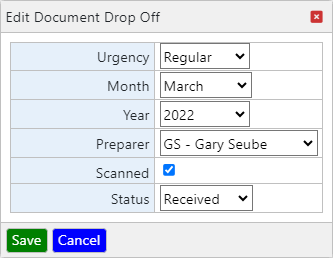

- Document Drop Off to record when a document is received.

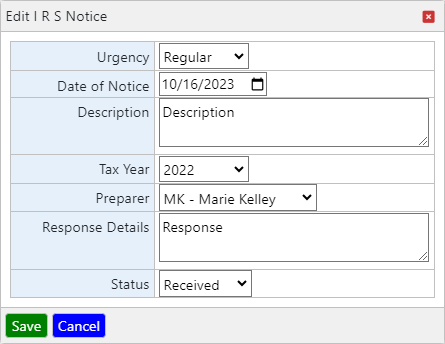

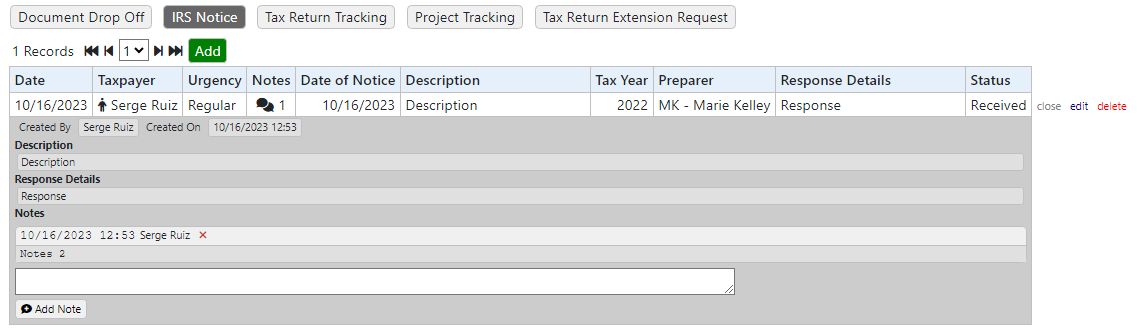

- IRS Notice when mail from the IRS is received.

- Tax Return Tracking when a document is related to the a federal Tax Return.

- Project Tracking when a document is related to another service than a federal Tax Return.

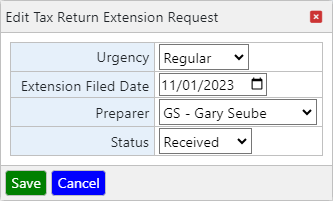

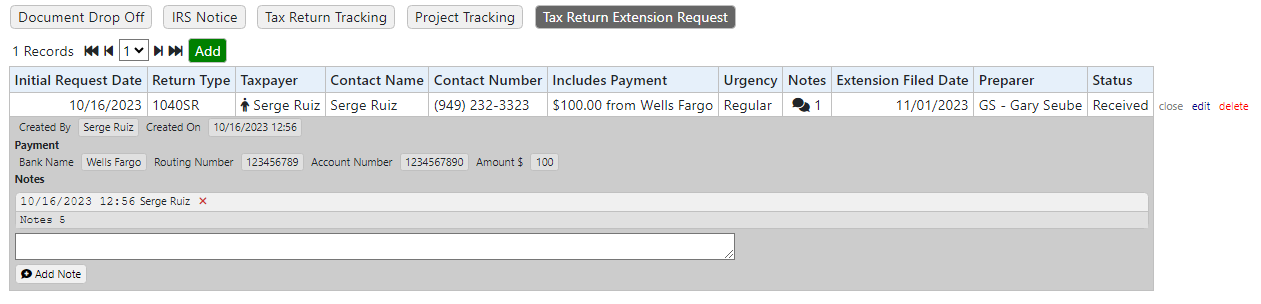

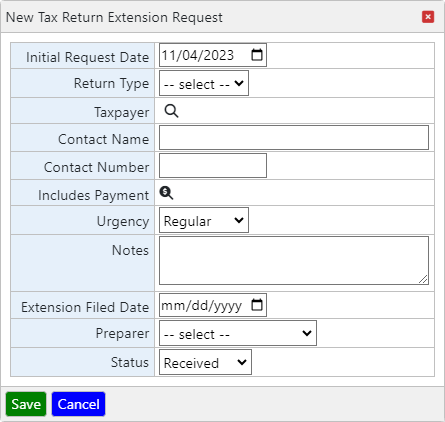

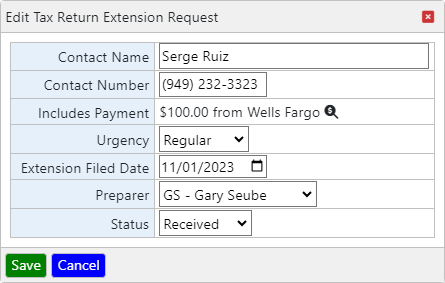

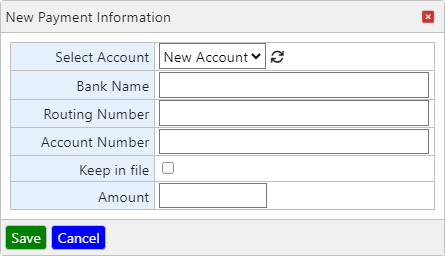

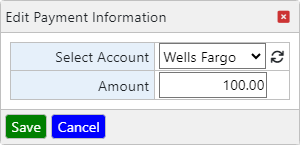

- Tax Return Extension Request when a document is about an extension to a Tax Return.

The category in which a dropped document fits will determine, if any, what other transaction it falls under, and additional fields will appear to allow the recording of both records at once.

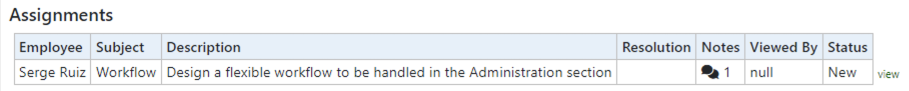

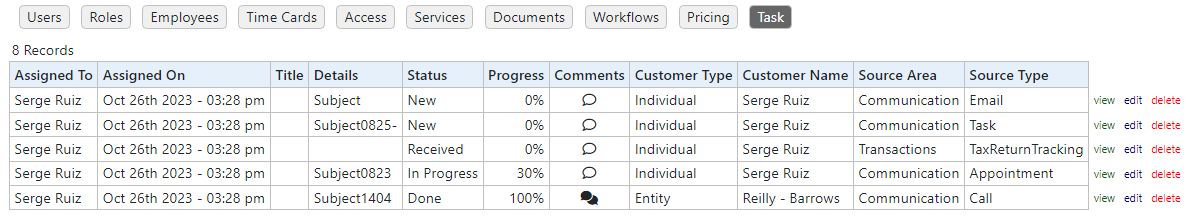

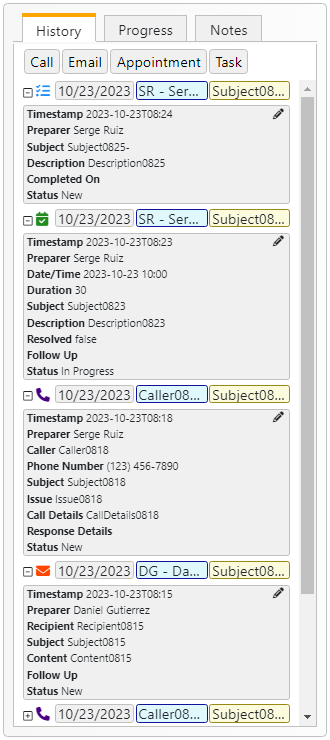

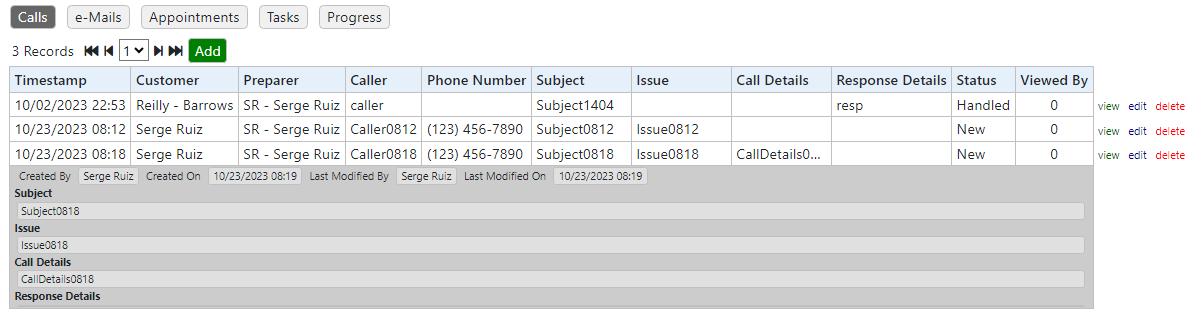

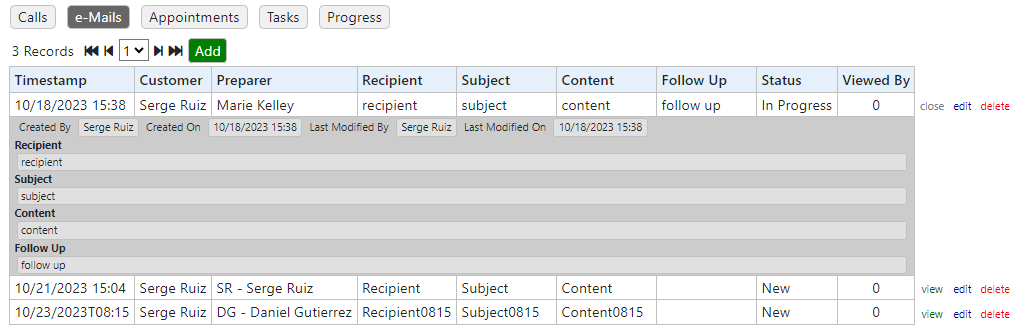

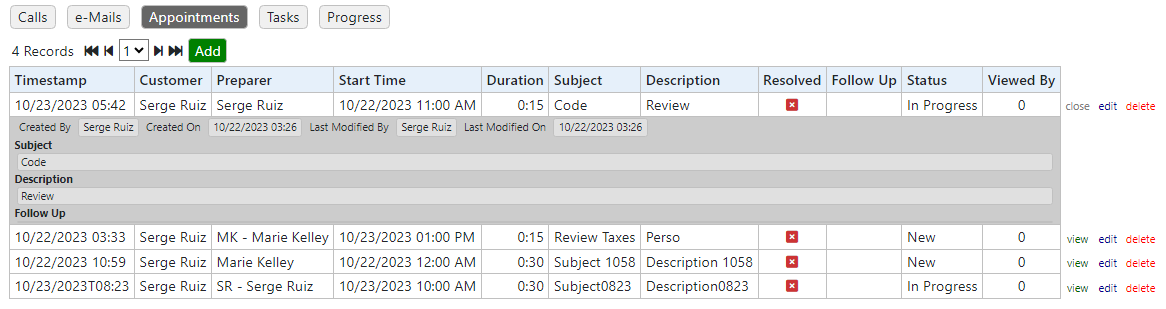

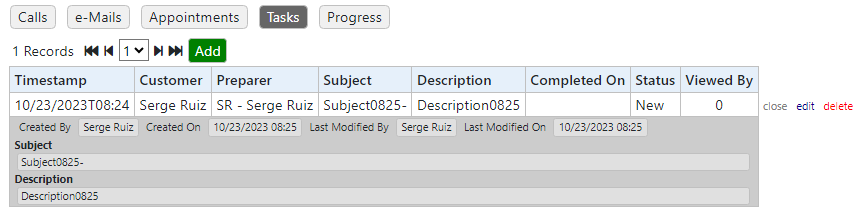

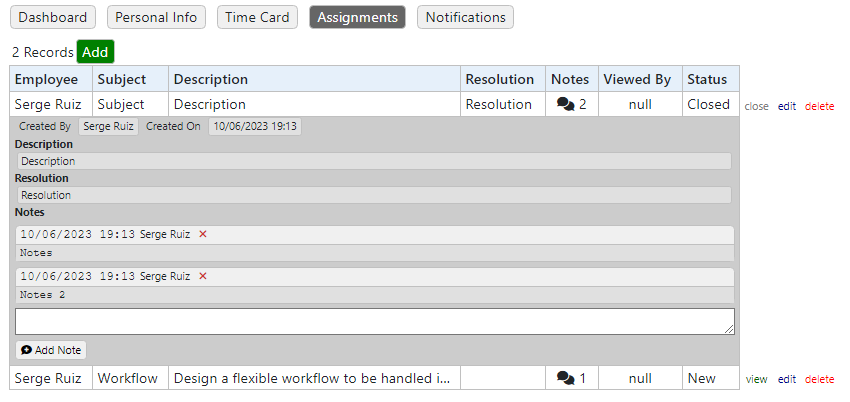

For all records in the lists below, the fields that can potentially receive a lot of data will be shown as an icon that hints to the size of its content.

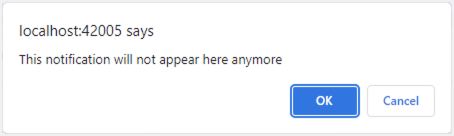

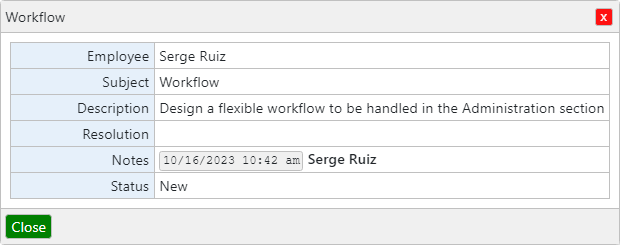

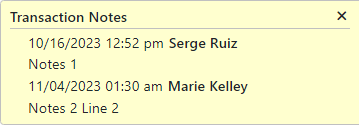

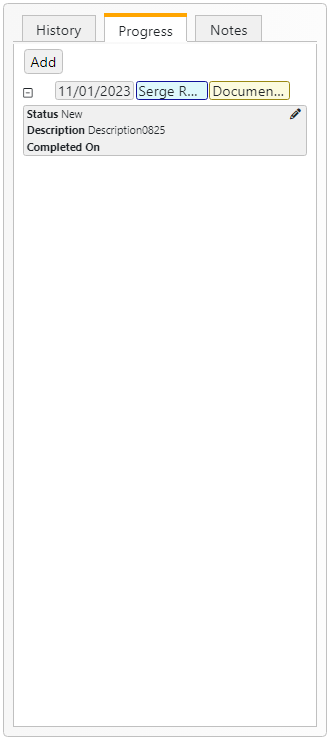

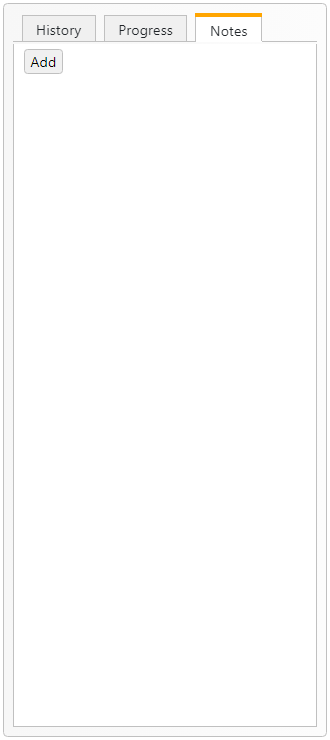

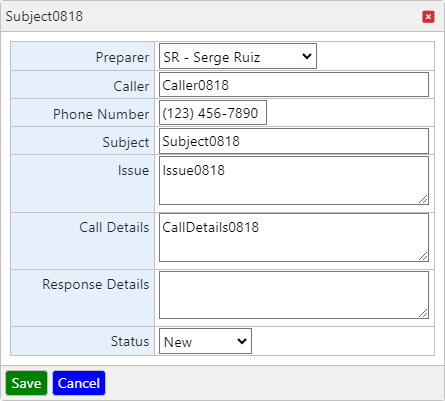

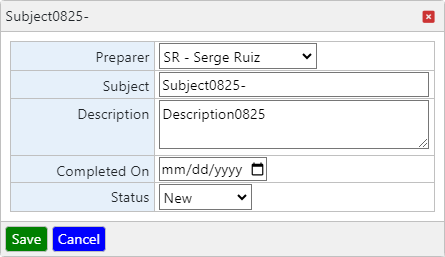

The view link will show the details of the transaction record and allow additional notes to taken, existing notes to be reported as seen, or notes to be removed under certain conditions.